Trucker Access › Forums › Diesel News › Why Sustainability Matters for Trucking Success – Fuel Smarts

- This topic has 0 replies, 1 voice, and was last updated 11 months, 1 week ago by

EazyRiDer66.

EazyRiDer66.

-

AuthorPosts

-

May 11, 2024 at 12:00 am #19668

EazyRiDer66Keymaster

EazyRiDer66Keymaster

For Matt Cathey, vice president of operations for Alabama-based Buddy Moore Trucking, ESG was not something he knew much about — until a request from a major customer.

ESG stands for environmental, social, and [corporate] governance. Companies such as shippers and institutional investors look to ESG reports to get insight into how a company operates in regard to the planet and its people. This is also tied into the idea of sustainability.

For trucking, the biggest example of ESG data is carbon emissions.

About three years ago, Buddy Moore Trucking got a request from a major customer to complete a questionnaire from a company called EcoVadis. This is a third-party company that provides business sustainability ratings.

“We kind of filled it out,” he says. “We didn’t put our best foot forward. We didn’t get where we needed to be.”

A year later, that customer explained in a meeting that eventually, it would require a minimum score from EcoVadis from its suppliers — including the motor carriers hauling its goods.

Buddy Moore Trucking (recently acquired by PS Logistics) had a challenge on its hands when asked by a major customer to provide ESG data.

Photo: Buddy Moore Trucking

How Customers Evaluate Your Trucking Fleet’s Sustainability

Cathey says “a light bulb went off” for him after the meeting with that customer. ESG scores, he realized, are going to be weighted by shippers when deciding who to do business with, just as they do with factors such as lanes, rates, on-time service, CSA scores, and use of EDI.

It might not be through EcoVadis, but today, he says, more and more customers are asking about ESG initiatives in their requests for proposals or rate quotes.

And Buddy Moore Trucking is not alone.

“Sustainability has become an important call-out in RFPs,” says Shawntell Kroese, AVP of sustainability and sales operations for Werner Enterprises.

“They’re trying to understand our fit with their company, culture and needs, as they’re assessing who they want to work with. They want to understand what our program is, how we think about it,” she explains.

“We are in a great position to help our customers in their efforts to reach or surpass their goals.”

[embed]https://www.youtube.com/watch?v=XuB5tKAPE1w[/embed]

Why ESG is Important

Sustainability initiatives in the transportation industry are becoming increasingly vital for shippers and other businesses involved in freight movement, thanks to a combination of environmental, economic, and regulatory factors.

Many trucking companies and major private fleets have ambitious climate-change, ESG and emissions-reduction goals because it’s a part of their company’s core principles — and because there are business benefits, as well.

Beth Davis-Sramek is the chair of the Department of Supply Chain Management at Auburn University in Alabama. She explains that climate change is something businesses need to address in a more proactive way than just trying to stay ahead of regulators.

In 2020, Larry Fink, CEO of Blackwater, an asset manager holding about $10 trillion in assets, essentially threw down the gauntlet and said he believed that climate change is an issue that businesses and investors have to be concerned about.

“There is going to be a significant reallocation of capital around companies that report and disclose what they are doing to mitigate climate change,” Fink said in his annual CEO letter.

Or, as Davis-Sramek puts it, “The guy with the money said, ‘This is where the capital’s going.’”

Ever since, we’ve seen an increased focus on sustainability among major global businesses.

Climate Change Becoming a Supply-Chain Priority

The 2023 United Nations Global Compact–Accenture CEO Study surveyed more than 2,600 CEOs from 128 countries and 18 industries. It found that 98% of those CEOs feel it is their role to make their business more sustainable. Half of CEOs in the study are prioritizing lowering greenhouse gas emissions in their supply chains.

As Accenture titled a story about the report on its website, “Want business growth tomorrow? Act on climate today.”

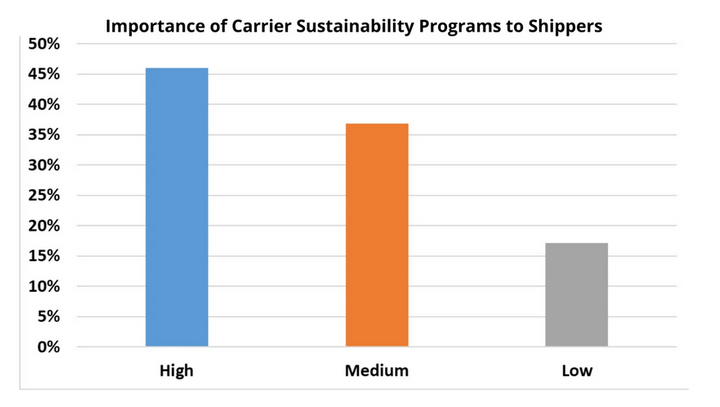

Similarly, in Averitt’s ninth annual State of the North American Supply Chain Survey of more than 1,400 shippers, nearly half said a carrier’s sustainability program is of high importance.

“By adopting sustainable practices, trucking carriers can significantly reduce their carbon footprint to align with global efforts to combat climate change,” the less-than-truckload carrier explains in a blog post about the survey results.

“This is not just beneficial for the environment, but also aligns with growing consumer and investor demand for environmentally responsible business practices.”

Understanding Scope 1, 2 and 3 Emissions in Transportation

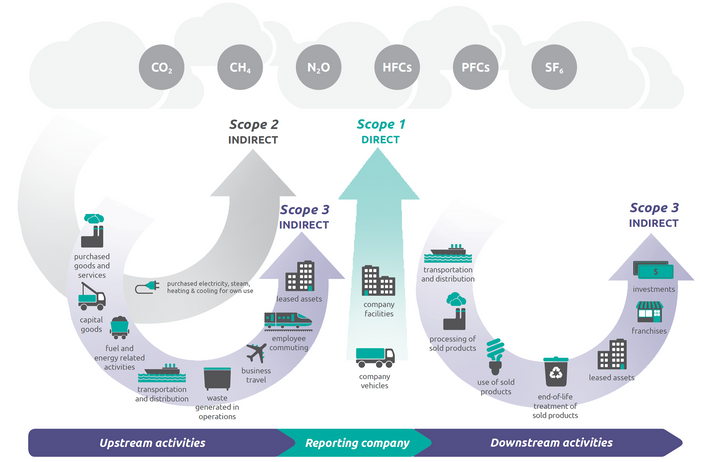

In conversations with their customers, trucking companies are likely going to hear the terms Scope 1, Scope 2, and Scope 3 greenhouse gas emissions.

- Scope 1 emissions are direct emissions that result from the assets that you own. If you own trucks, you are producing a lot of Scope 1 emissions.

- Scope 2 emissions result from the electricity that you buy and pull from the grid to power your facilities. How much do you use? What’s the source of the energy?

- Scope 3 is everything else, and a huge part of that is a company’s supply chain.

Your fleet’s Scope 1 emissions are part of your customers’ Scope 3 emissions.

The key for trucking is that a fleet’s Scope 1 emissions are part of a shipper’s Scope 3 emissions.

“The Scope 3 is just a bear,” explains Davis-Sramek. “It’s the big companies, the big globals, that are trying to figure out how to tackle that.

“For most companies, if you’re getting a sense of what your Scope 1 and Scope 2 are, you’re way ahead of the curve.”

What’s Your Trucking Company’s ESG Score?

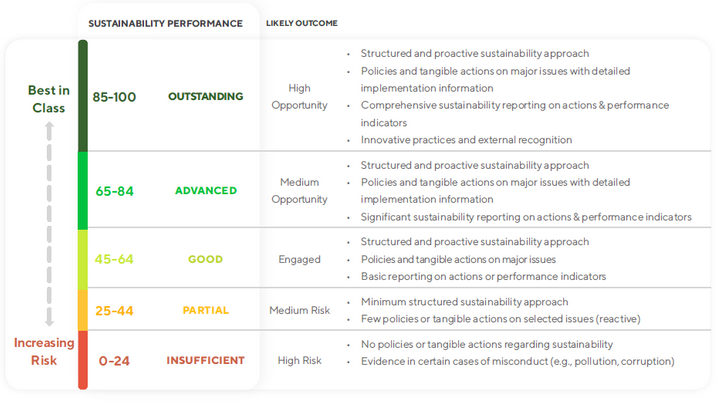

As companies look at how to manage their supply chain more efficiently and sustainably, some are outsourcing to a third party, such as EcoVadis, the task of giving motor carriers an ESG score. Then the shipper sets a minimum standard carriers have to meet to even work with them.

EcoVadis, Davis-Sramek says, has scored more than 128,000 companies, and the average score is about a 50. Fewer than 1% of those companies get an “outstanding” rating, she says. “So it’s a rigorous rating system.”

In Buddy Moore Trucking’s case, Cathey turned to Davis-Sramek and the business college at Auburn for help.

“I didn’t understand what they were asking,” he says. “The questionnaire, it’s daunting.”

Davis-Sramek helped BMT figure out what the EcoVadis questionnaire was looking for in areas such as the environment, labor, human rights, ethics, and sustainable procurement, and how to answer some of the questions. (See “Beyond GHG: The Increasing Importance of the ‘Social’ Part of ESG” below.)

BMT improved its EcoVadis score from 40, which was below the level the shipper was looking for, to 51, or bronze.

“We have worked so hard; I’m so proud of that,” he says. The goal is to achieve a score of 60 on the next one.

Crunching the Carbon Emissions Numbers

Buddy Moore Trucking and the team at Auburn had to dig into some pretty specific carbon emissions calculations for the EcoVadis survey.

Cathey worked with Davis-Sramek and some of her senior students to develop a formula to determine the fleet’s carbon emissions using raw data from the trucks in the fleet, such as miles driven and fuel mileage, and convert that into metric tons of CO2.

Then, looking at the EcoVadis framework, the Auburn team made recommendations on areas where the fleet could reduce carbon emissions and improve their overall ESG scores.

Setting goals and developing a sustainability report was an important part of the process. The students turned to sustainability reports from major corporations such as Walmart and DHL as examples.

For instance, in the Environment section, they recommended starting with a company sustainability mission statement and long-term, large-scale goals. Then, they said, set shorter-term goals and outline plans on how to accomplish that.

Some companies are turning to third parties such as EcoVadis to evaluate their supply-chain partners.

Trucking Fleets Big and Small Look to Calculate Sustainability Metrics

Larger companies such as Werner are more likely to be ahead of the curve on this, but there are lessons for smaller fleets to be learned from their experiences. And even they are still in the process of developing ways to calculate the numbers involved.

In 2020, Werner Enterprises was one of the first major trucking companies to publicly detail ESG initiatives. The company, which has more than 8,000 trucks and 30,000 trailers, is working toward a 2035 goal of reducing its GHG emissions by 55% compared to a 2020 baseline.

In order to accomplish this kind of quantified data reporting, you’ll need to develop data reporting practices at your company. And different customers will want different information, says Werner’s Kroese.

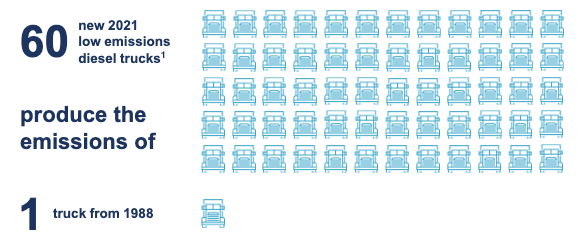

You don’t need to buy zero-emission trucks to improve your ESG status. Over the last three decades, emissions from new trucks have been reduced by more than 98%.

“What I’ve seen is that a lot of our customers, they want it in different frequencies.” For some, yearly is enough. Others may want it more frequently. Some want a general look at their total CO2 emissions. Others may want it broken down by factors such as loaded and empty, or by product hauled.

“So you can imagine it gets kind of complicated pretty quickly as you think through the varying needs of how the customer is going to be able to use that data as part of all this other stuff that they’re trying to measure in terms of their Scope 3,” Kroese says.

Where to Start With a Trucking Fleet Sustainability Program

In order to set goals, you need to understand where you’re starting from. That’s why less-than-truckload carrier Estes recently signed a deal with Watershed, a major enterprise sustainability platform, to assess its sustainability program and set benchmarks.

The first phase of Estes’ work with Watershed is to complete its first-ever carbon footprint. Estes then will use that 2023 footprint as a baseline to start analyzing its emissions data and identify emissions hot spots. This will help the company fine-tune its emissions-reduction targets.

Estes, which recently expanded its zero-emission fleet with Freightliner eCascadias in Banning, California, is embarking on an initiative to put a baseline number to its sustainability efforts.

Some of Estes’ recent sustainability initiatives include expanding its electric-vehicle fleet of 12 electric trailers and nearly 300 zero-emission forklifts and retrofitting select terminals with solar panels.

“We’re eager to see how Watershed quantifies the work we’ve already done in this space and helps us identify additional ways to manage our carbon output more effectively,” said Sara Graf, vice president of sustainability, culture and communications, in a news release.

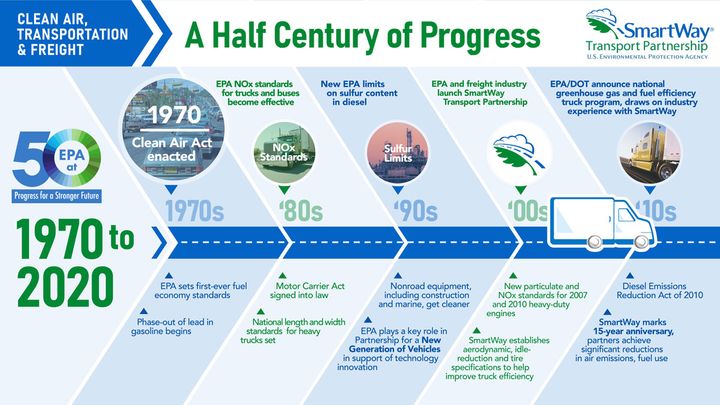

Trucking Decarbonization Help From SmartWay and More

Kroese points out that Werner, like many carriers, has been working with the Environmental Protection Agency’s SmartWay program, which can be a starting point for some of the data customers may be looking for.

“Way before we even published our CSR report and set our public goals, we were disclosing our Scope 1 emissions through the SmartWay program,” she says. “And I think that helped make sure that what I would call the basics were being collected.”

There are many consultants and other companies that may offer help in putting numbers to a fleet’s ESG goals — including leasing and fleet management companies such as Fleet Advantage, technology companies such as Samsara, and consultants such as TRC (a global sustainability consulting firm that now includes Gladstein Neandross & Associates, or GNA, which focuses on market development for low- and zero-emission transportation technologies in North America.)

The EPA’s SmartWay program offers a starting point for measuring sustainability progress.

Different Trucking ESG Data for Different Shipper Customers

The kind of data involved can be daunting. But Kroese points out that not all shippers are asking for the same level of detail.

“I think there’s a lot of collaborative conversations, because there are a lot of different ways that we can work with our customers to reduce their carbon emissions for their business,” she says.

For instance, one way Werner reduces emissions is by operating the newest tractors and trailers possible. The company points out that over the last three decades, emissions from new trucks have been reduced by more than 98%.

Alternative fuels such as renewable diesel or renewable natural gas may make sense for some customers.

“Beyond what I would call the exciting stuff, all the new technologies, a lot of it is just pure operations and efficiencies,” Kroese says. “How do you take out empty miles, how do you keep things in engineered networks that reduce idling and downtime?”

Route optimization is one example. Moving some freight to intermodal is another tactic.

Asked what advice she might have for smaller fleets, Kroese says, “You’ve you got to start somewhere. It can feel very overwhelming.

“Step one might be as simple as, start having active conversations with your customers, find out what they want.”

Those conversations may lead to discovering you can provide some information that your customers want, or you may be able to identify steps to take to get there. For instance, you may discover that you need to get your fuel information sent to you in a different format, Kroese says.

“We definitely have been on a journey here,” she says.

In Averitt’s State of the North American Supply Chain Survey of more than 1,400 shippers, nearly half said a carrier’s sustainability program is of high importance.

Improving Trucking Fleet Sustainability is a Journey

And that journey is far from over. As Buddy Moore Trucking’s Matt Cathey says, “This is not something that you do to check a box and then it’s done.

“It’s a journey,” he says. “It’s constantly, where are we at now, what are we doing, what do we have going on?

“I feel like now we’re kind of ahead of the curve, but there’s pressure coming from the investors and that just flows downstream. So I would try to get ahead of it as soon as you can.”

Beyond GHG: The Increasing Importance of the ‘Social’ Part of ESG

For trucking, emissions reduction tends to be the biggest focus of ESG scores from a shipper perspective. But that doesn’t mean the “social” and “governance” parts of it don’t play into shipper or investor evaluations of a company, as well.

“The rise in the ‘S’ in ESG is redefining the role that business is expected to play,” says a UN/Accenture CEO study, which surveyed 2,600 CEOs from 128 countries and 18 industries.

Looking at how CEOs view the challenges they face, the report says, “the most notable change has been the rise of social sustainability expectations on CEOs and businesses.”

The report found that 91% of CEOs believe that their role is to protect local communities in theregions they operate.

That was one way Buddy Moore Trucking was able to improve its EcoVadis ESG score.

The Auburn business school team assisting BMT recommended that the Alabama-based motor carrier look at areas such as:

You may already be doing things that would improve your ESG profile but just need to get it down into writing.

For instance, is your company involved in Truckers Against Trafficking? What philanthropic activities is your company involved in?

How Written Policies Can Improve ESG Scores

In some areas, it was simply a matter of putting certain things into written policies.

BMT’s Matt Cathey explains that the company needed to create company policies for some things that were covered by government regulations. He cites as an example the requirements for a commercial driver’s license and the minimum age of 21.

“If you look at it through the lens globally, we should have a policy that says you have to be 21 to have a CDL,” he explains, “You can’t hide behind, ‘Well, in America the policy is X.’ You have to look at it globally, because you will do business with customers that look at it globally.”

-

AuthorPosts

- You must be logged in to reply to this topic.