Trucker Access › Forums › Diesel News › Trucking Overcapacity Still Constraining Freight Rates – Fleet Management

- This topic has 0 replies, 1 voice, and was last updated 11 months, 1 week ago by

EazyRiDer66.

EazyRiDer66.

-

AuthorPosts

-

May 10, 2024 at 4:00 am #19386

EazyRiDer66Keymaster

EazyRiDer66Keymaster

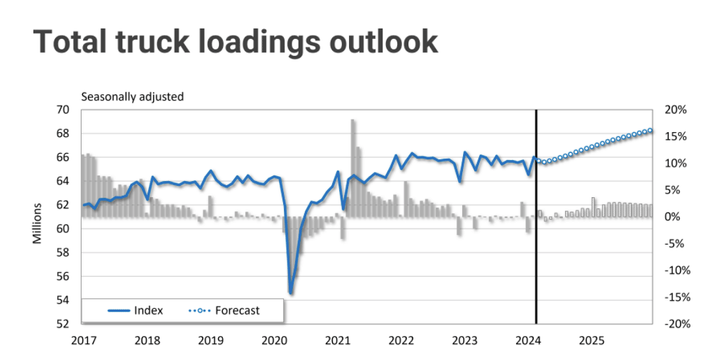

FTR’s truck loadings forecast calls for very gradual growth.

The overall economy is performing better than many people think, but overcapacity in the trucking industry is still keeping freight rates from rising. Among the key takeaways from FTR’s State of Freight webinar on May 8:

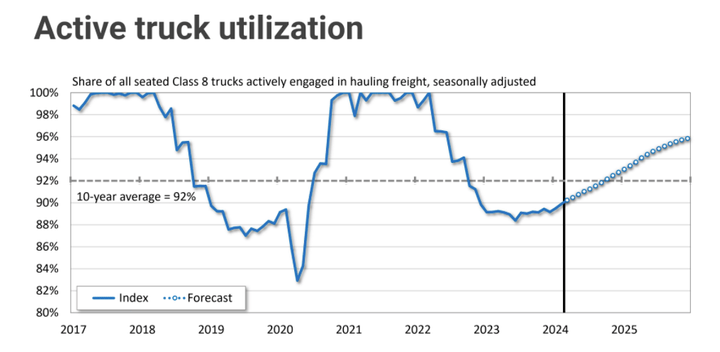

- Active truck utilization has bottomed out and is starting to recover.

- The number of new carriers coming into the industry is now less than the number of carriers leaving the industry.

- Insurance rates have been steadily increasing the past year.

- FTR expects truckload rates, both spot and contract, to start creeping upwards.

- There’s too much inventory of medium- and heavy-duty trucks on dealer lots.

- It’s unclear what effect the 2027 emissions prebuy will have on truck orders.

How is the Overall Economy Performing?

Looking at consumer spending, goods spending has been fairly flat, but it’s still above the long-term trend, said FTR Chairman of the board Eric Starks.

Looking at payroll changes, he said, “The economy continues to keep generating jobs, and at a pretty good clip. We’re getting back to something we should expect based on the outlook for this market.”

And it looks like consumers are still spending. While some worry that the spending may be as the result of consumers taking on more debt, Starks said, if you look at household debt numbers, those are still at or slightly below pre-pandemic levels.

And while credit card delinquency rates are on an upward trend and bear watching, it’s not overly concerning at the moment, he said.

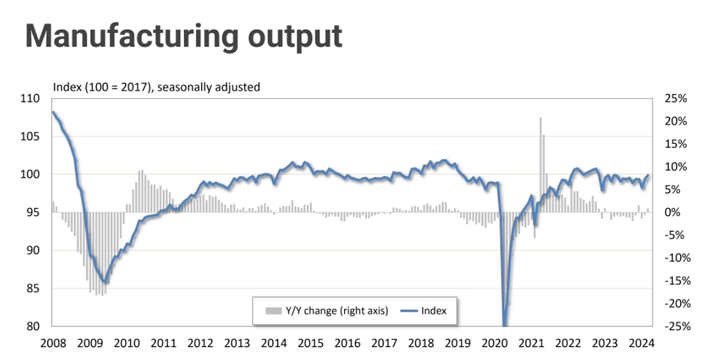

“Manufacturing is the lifeblood of transportation,” Starks said. Those numbers have been affected by a lot of external problems related to the pandemic, especially the supply-chain issues manufacturers were facing.

“Overall we have been fairly flat” in manufacturing, he said – decent levels, but growth hasn’t turned the corner.

“Industrial production tells a little different picture. We saw manufacturing at the end of 2022 stall out a little bit and it’s kind of been bouncing around.

“As we look out, growth is not awesome by any stretch of the imagination as we move through 2024 and into 2024,” he said. If this trend continues, “the amount of freight is somewhat constrained in this environment.”

GDP and Trucking

Real gross domestic product, or GDP, growth came in at 1.6% for the first quarter, which was lower than many had expected. But FTR anticipates the rest of 2024 and 2025 will see moderate GDP growth of around 2%.

For trucking, FTR calculates what it calls the GDP Goods Transport Sector, where it counts the import numbers that regular GDP does not, since imports result in freight movements, even if they aren’t part of the country’s production.

“What we see is the growth rate is higher than industrial production, so we get closer to that 2.5, 3% growth rate,” he said.

“Traditionally we need to see something above 2.5% in this metric to show material increases in generation of freight. This is a fairly status quo type of forecast.”

But we’ve been in this environment so long, he said, people are always looking for the other shoe to drop.

Trucking Outlook: ‘Transition to Growth’

FTR’s total truck loadings outlook, which includes all truck freight, not just over-the -oad dry van, shows that “last year was essentially a flat year, and this year’s going to be pretty close to flat as well,” said Avery Vise, FTR’s vice president of trucking.

“But we are going to start seeing a little bit of improvement later this year, and see year-over-year growth starting in the third quarter,”

It’s “starting to transition to growth, although not terribly robust growth,” he said. “And we see a stronger market next year.”

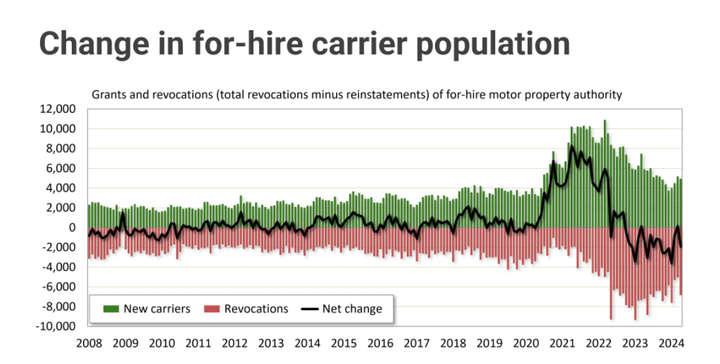

The number of carriers leaving the industry is now greater than the new ones being added, but we still have some 90,000 more motor carriers than we did pre-pandemic.

Soaring spot rates in the wake of pandemic-era supply chain problems prompted a lot of new small, one-or-two truck motor carriers to get their own authority. That dynamic “far outstripped anything we had ever seen in the market,” Vise said.

That dynamic peaked in 2021 for the most part, and in 2022 the carrier base started to decline consistently on a net basis – more carriers were failing than were entering the market.

However, we still have some 92,000 trucking firms with active operating authority more that we did before the surge in new entries began in 2020.

Overapacity is keeping freight rates down.

FTR’s active truck utilization peaked at 100% in 2021 and bottomed out around 88% in 2023. Vise said once that utilization index hits around 92%, it starts to exert upward pressure on rates.

“The market has finally turned, although not rapidly.”

In truckload spotload rates, Vise said, “we’ve seen some volatility, but we see rates rising and turning positive by the third quarter.” Dry van and refrigerated rates are stronger than some other sectors.

As trucking capacity shrinks, freight rates will start to rise again.

Contract rates appear to have bottomed out, Vise said.

“In absolute terms rates are still quite high,” he said, but cautioned that with higher costs for driver pay, equipment, and so forth, it may not be reflected in motor carrier profit margins.

One “X factor” of uncertainly, he said, is that we’ve seen a resumption in insurance costs rising after things flattened out. The steady increases we’ve seen over the past year aren’t the dramatic sharp increases seen in 2019, but it could be another factor that pushes more small carriers out of business and tightens capacity.

“We still have such a large overhang in capacity,” Vise said. “Our freight forecasts are stronger than our rate forecasts for that reason.”

Medium- and Heavy-Duty Truck Sales

Dan Moyer, a recent addition to the FTR team as senior analyst, commercial vehicles, reported that North American Class 8 net orders for 2024 year to date are up 21%, even though March was down 28 percent month over month. Certain segments, such as vocational trucks and day-cabs used for less-than-truckload, are doing better than over-the-road.

Backlogs have been coming down some, with build slots filled out through Q2 or Q3 of this year, but retail sales have been seeing declining trend for the last three to four quarters he said.

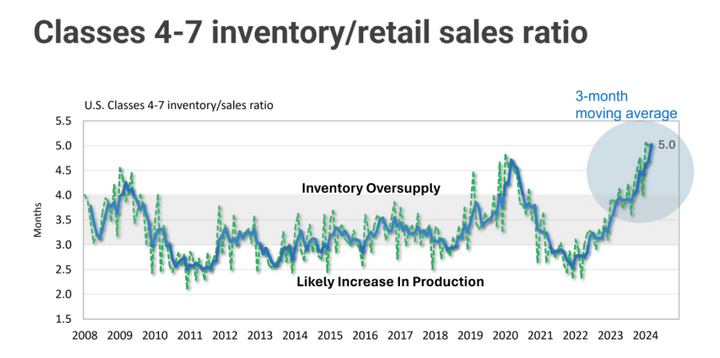

This has led to an inventory-to-retail sales ratio at pretty high levels.

For Class 8, there were about three months’ worth of inventory on dealer lots, Moyer said, which is higher than what would be typical.

There’s a record high inventory to sales ratio of medium-duty trucks.

In medium-duty, he said, there are record levels of inventory on dealer lots, crossing over 100,000 for the first time in history.

Is it possible that dealers are already stockpiling trucks in anticipation of a large pre-buy?

New 2027 tailpipe emissions and greenhouse gas regulations that start kicking in with the 2027 model year could drive fleets to go ahead and buy current, tried-and-true models and postpone buying the new lower-emission trucks until any bugs have had a chance to get worked out.

-

AuthorPosts

- You must be logged in to reply to this topic.