Trucker Access › Forums › Diesel News › Tesla Semi Update Still Leaves Questions – Fuel Smarts

- This topic has 0 replies, 1 voice, and was last updated 10 months, 4 weeks ago by

EazyRiDer66.

EazyRiDer66.

-

AuthorPosts

-

May 24, 2024 at 11:30 pm #22104

EazyRiDer66Keymaster

EazyRiDer66Keymaster

“I know it’s been alluded to there’s been some question on timing,” said Tesla’s Dan Priestley at ACT Expo. “Tesla’s specialty is turning the impossible into merely late.”

Photo: ACT Expo/TRC Companies

Like Moses coming down from The Mount, Dan Priestley, head of the Tesla Semi program, strode onto the stage at ACT Expo in Las Vegas to hoots and cheers from a few dozen fanboys sitting at the back of the room. Most of the audience just clapped politely.

Priestley was there to provide an update on the progress with the Tesla Semi and to shed some light on the electric truck-maker’s future plans. Priestley’s update took less than 15 minutes. It was followed by a 30-minute Q&A session with moderator Erik Neandross, CEO of ACT Expo host, GNA.

Attendees learned little they didn’t already know.

Priestley began by good-naturedly addressing Tesla’s chronic inability to deliver.

“I know it’s been alluded to there’s been some question on timing,” he said. “Tesla’s specialty is turning the impossible into merely late.”

Tesla has been notoriously close-lipped about the Semi details since Tesla CEO Elon Musk wheeled an early version of the truck across a stage in Hawthorne, California, back in November 2017. ACT Expo is the first time a Tesla executive has addressed a trucking-specific audience about the Semi.

ACT Expo was the first time we’ve seen the Tesla Semi on display at a trucking event since the platform was announced in 2017.

When the Semi was first unveiled in 2017, Musk said Semi production would begin in 2019. Full production was slated to start in 2022, eventually ramping up to 50,000 units by 2024. After several delays, we saw the first real-world Tesla Semi trucks, decked out in Pepsico and Frito-Lay colors, during an event in December 2022.

in April 2023, Musk said Tesla would be producing 50,000 units a year by the end of the year. That deadline came and went, too. In October 2023, we learned that Tesla had produced fewer than 70 trucks to date.

Priestley said the current plan is to be building 50,000 trucks a year by 2026 — almost a decade after the project was originally announced — with the first scaled deliveries beginning in late 2025.

So … Just How Much Does the Tesla Semi Weigh?

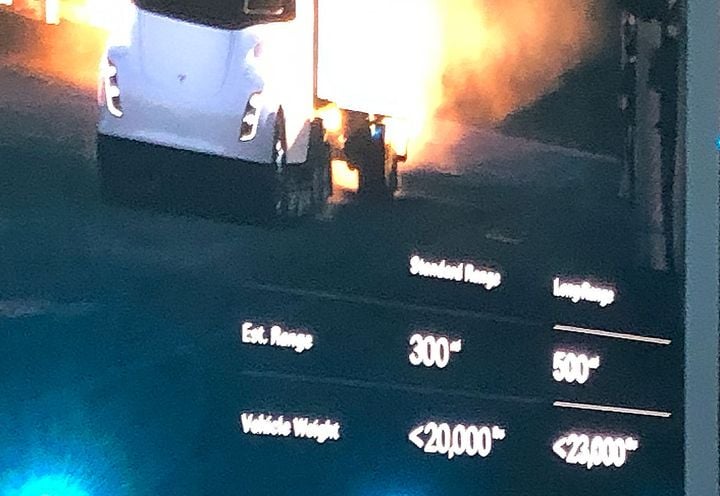

He then tiptoed around the tare weight of the Semi. Without ever mentioning a number, he referred to a slide on a screen comparing the standard and long-range versions of the truck.

“One thing I want to call out is the numbers you’re seeing on the screen,” he said referencing a slide that showed a 300-mile version of the Semi with a tare weight of less than 20,000 lbs. and a 500-mile version weighing less than 23,000 lbs.

“These are tare weights that are attainable (emphasis added) on planned production products based on the learnings we’ve had thus far.”

Not actual tare weights of real-world working Tesla Semis, but attainable weights on planned products. He never hinted at what the thing actually weighs currently.

“Achieving a strong range-to-mass ratio is only possible with a dedicated first-built, ground-up electric platform, which is exactly what this is,” he added, a knock against existing OEMs for developing electric powertrains on platforms designed for diesel engines.

This slightly misleading slide shows tare weights for the standard and long-range version of the Semi. As Priestley explained, the weights shown represent attainable tare weights in future versions of the truck, not the actual weight of current working Semis.

Is the Tesla Semi More Freight-Efficient Than SuperTruck 2?

Having accumulated 3.5 million miles on the platform, Priestley said Tesla is now using the trucks in its own supply chain. They haul battery packs from the Nevada Gigafactory to an assembly plant in Freemont, California, about 260 miles. It’s downhill much of the way, including about 30 miles of steep grades through the Donner Pass.

Tesla had two Semis in the ACT Expo Ride & Drive event at ACT Expo in Las Vegas. Guests were permitted only to ride in the truck. Even 45-year veteran CDL holders were relegated to the back seat.

“This is a long-distance route, and a challenging one,” he said. “We see a lot of mountains and a huge variety in climate and conditions: cold in winter, hot in summer, you have high speeds of 70 mph in Nevada and urban traffic [nearer the destination]. We are able to do this at one-for-one payload parity with diesel trucks.

“Across the fleet, we’re seeing an average of 1.7 kilowatt/hours per mile,” Priestly said. “Even in heavy-haul applications, we’re seeing less than 2 kilowatt-hours per mile. In light applications, some of the trucks are down to about 1.5 kilowatt-hours per mile.”

With the appropriate energy conversion, Priestly maintains the Semi offers greater freight efficiency than even the latest demonstrations we saw in the EPA’s SuperTruck 2 program.

“SuperTruck 2 hit their targets, but last year’s Tesla semi fleet outpaced them,” he said. “If we load up the vehicle to max weight, we crush it even farther.”

But we still don’t know what that max weight is or what the battery capacity is.

Tesla’s Plans to Scale the Electric Semi Truck

Tesla is already running about 35 trucks at two Pepsico plants in Modesto and Sacramento, California. Priestley said about 50 more trucks will be delivered in the very near future.

It’s been a successful pilot, with two of the trucks participating last year in the North American Council for Freight Efficiency’s Run On Less Electric – Depot program.

During the pilot, Tesla deployed megawatt charging at one of the facilities. The quicker charge times enable Semis to operate more than 1,000 miles in a 24-hour period.

“We’ve demonstrated that megawatt-level fast charging is available, reliable, safe, and unlocks a next level of economics,” Priestley said. “This unlocks operational equivalence between diesel and electric.

“This pilot fleet and everything that goes along with it, shows we’re technologically ready. Electrification can be done. Now it’s time for scaling.”

Adding More Fleets to Expand Tesla Semi Pilot Program

Tesla plans to team up with some other private fleets to expand the pilot. Private fleets are ideal candidates for electrification because they have a greater degree of control over their operations. Priestly characterized those operations as “a bit more seamless.”

Recently, Tesla Semis have been spotted bearing the logos of Costco and Martin Brower.

NEWS: COSTCO HAS RECEIVED DELIVERY FOR TESLA SEMI. pic.twitter.com/dExebm7VUn

— Elon Musk 𝕏 (@elonmusk_1516) May 12, 2024

Tesla will be flexing the Semi platform to serve as many customers as possible with as general a tool as possible. They will also be looking to enable other use cases, such as car hauling and supporting electrified reefer trailers directly from the truck.

Regardless of how many new avenues Tesla might try, they are eventually going to run into the same obstacle faced by the “legacy” OEMs. The appetite exists for electric trucks, but the ability to deliver is seriously constrained by the lack of charging infrastructure. Potential buyers are finding little need for a truck they must get the infrastructure to support its operations.

Unless Tesla also plans to build out a network of small-scale nuclear generating stations, they will eventually face the same roadblocks as everyone else.

-

AuthorPosts

- You must be logged in to reply to this topic.