Trucker Access › Forums › Diesel News › Signs of Recovery Amid Trucking Overcapacity Woes? – Fleet Management

- This topic has 0 replies, 1 voice, and was last updated 11 months ago by

EazyRiDer66.

EazyRiDer66.

-

AuthorPosts

-

May 5, 2024 at 3:15 pm #18296

EazyRiDer66Keymaster

EazyRiDer66Keymaster

Too many trucks are still chasing too little freight.

Trucking is still suffering from the overcapacity hangover that developed in the wake of the Covid-19 pandemic boom, but some major truckload fleets are refusing to lower rates any further. Are there green shoots indicating a freight market recovery on the horizon?

Another Quarter of Freight Recession

The U.S. truck freight market continued to underperform the broader economy during the first quarter, according to latest U.S. Bank Freight Payment Index, released May 1.

The U.S. Bank National Shipments Index contracted significantly from both the final quarter of 2023 and a year earlier.

Several factors contributed to declining truck freight levels during the first three months of the year, including bad winter weather in many parts of the country.

While there are indications that freight levels rebounded slightly in February, a strong March freight market didn’t materialize as it would during a typical first quarter, according to U.S. Bank.

Many sectors of the economy generate truck freight, but household consumption of goods was one major factor. If adjusted for inflation, the report said, retail sales likely fell in the 1.5% to 2.5% range in the first quarter.

Other sources of freight, like home construction and factory output, were flat during the quarter.

On top of that, freight shipping capacity was still high compared with the amount of freight available.

“While there was hope for a freight market turnaround to start the year, our data shows that the challenges continued,” said Bobby Holland, director of freight business analytics, U.S. Bank. “Nationally, this was the eighth straight quarter of year-over-year volume decreases and the fifth straight with a drop in spending.”

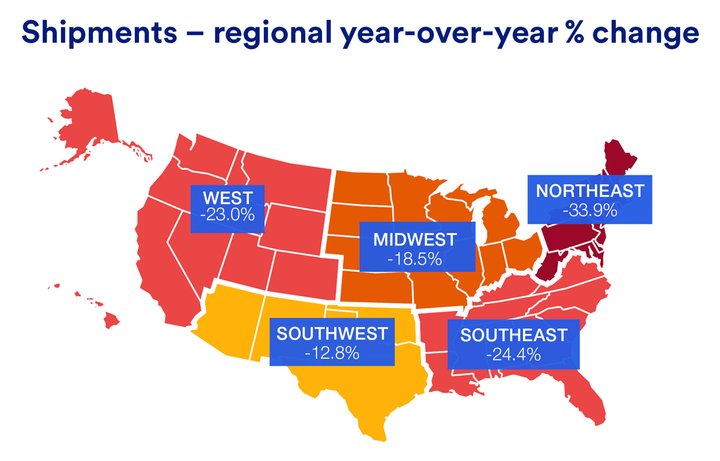

U.S. Bank’s shipment index was down 21.6% year over year. In the Southwest, Weaker factory output in the region was partially offset by higher cross-border freight from Mexico.

“Spending fell disproportionately to the drop in volume, which suggests downward rates pressure to start the year,” said Bob Costello, senior vice president and chief economist at the American Trucking Associations.

“Truck capacity remained above the amount of freight available. The degree to which this mismatch shrinks or expands will be important to watch throughout the year.”

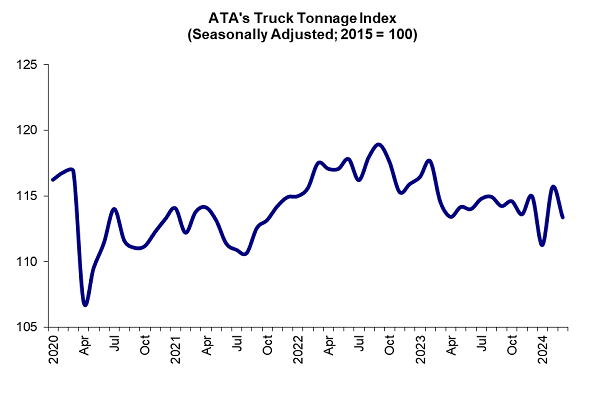

ATA’s truck tonnage index told a similar story. The seasonally adjusted For-Hire Truck Tonnage Index fell 2% in March after increasing 4% in February.

“Tonnage in March suggests that truck freight volumes remain lackluster, and it is clear the truck freight recession continued through the first quarter,” said Costello. “In the first three months of 2024, ATA’s tonnage index contracted 0.8% from the previous quarter and declined 2.4% from a year earlier, highlighting ongoing challenges the industry is navigating.”

ATA’s Tonnage Index shows the freight recession continued in the first quarter.

Source: American Trucking Associations

Signs of Green Shoots for Economy and Trucking

However, several analysts are cautiously optimistic that things are starting to turn around.

The trucking analysts at Stifel said in an email to investors that recent macroeconomic data has been more positive as the industrial economy is expanding again.

“Payrolls, unemployment, and retail sales remain relatively healthy, in our view, while the ISM [manufacturing index, also known as the purchasing managers’ index] re-entered expansionary territory in March for the first time in 18 months.

“But the impact of inflationary pressure lingers, leaving consumers uneasy and the Federal Reserve unlikely to move quickly ahead of a presidential election, while shippers still appear reluctant to restock in earnest, having been burned badly during the last down cycle.”

Cass Information Services: Steady as we Go

Cass Information Services reported that its indexes showed underlying volumes did show improvement in the first quarter, as the shipments component of the Cass Freight Index rose about 2% from the fourth quarter of 2023 (when seasonally adjusted.)

Cass produces four indexes that measure changes in freight volumes, rates, and overall spending. In March, none changed more than 0.2% on a nominal basis from February, leading it to title its report “Steady as we Go.”

“The 3.6% y/y decline was the smallest in a year, and although freight demand is broadly better than the for-hire market, it’s still hard to see amid ongoing private fleet growth.”

Stability continued for the Cass Truckload Linehaul Index in March, with a 0.2% month-over-month increase after a 0.1% month-over-month increase in February. The 4.7% year-over-year decline continued to gradually narrow.

The index has been in a very tight range, from 140.4 to 142.0, over the past nine months as the market finds a floor.

As a broad truckload market indicator, this index includes both spot and contract freight. With spot rates steady over the past several months, downward pressure on the larger contract market is lessening, with some instances of contract rate increases bucking the downtrend recently, Cass reported.

Trucking Freight Outlook Brightening

ACT Research on April 23, in a blog post titled “Freight Outlook Brightening,” reported that “the rebalancing process in the U.S. freight market is being drawn out by reluctance to part with workers and significant private fleet capacity expansion, even as pressure on fleets worsened this month as diesel prices spiked.”

“Although seasonality remains loose and demand soft, spot market dynamics have begun to shift since the end of operations at Yellow on July 31,” said Tim Denoyer, ACT Research vice president and senior analyst.

“While this is a game-changer for LTL rates, so far, the truckload market is still loose enough for rates to be largely unaffected. We see the impact growing over time, along seasonal patterns.”

ACT also noted that private fleets are still growing and pulling freight from the for-hire market.

Trucking Capacity Moving Toward Equilibrium with Freight Demand

Chris Brady of Commercial Motor Vehicle Consulting said linehaul fleets should have capacity in equilibrium with freight demand by the end of the second quarter.

For-hire carriers will initially absorb higher freight volumes by increasing truck utilization, which will slowly improve profitability.

“A slow upward trend in fleet capacity utilization will gradually swing the pricing pendulum towards carriers from shippers, which will slowly improve profit margins, but CMVC does not expect this to occur until sometime in 2025.”

Carriers Standing Ground, Taking Long View

First-quarter results for publicly traded trucking companies weren’t pretty. Motor carriers outlined ways they have been cutting costs and improving utilization.

Some trucking companies said they refuse to lower rates any further, saying they can’t agree to “unustainable” contract rates and need to be ready for the freight market upturn.

“The full truckload industry continues to be challenging and oversupplied with capacity,” Knight-Swift advised in its April 17 earnings guidance. “The early part of the bid season led to greater than expected pressure on freight rates, as some shippers are still trying to push rates down further. In some cases, we have lost contractual volumes because we were not willing to commit to further concessions on what we view as unsustainable contractual rates.”

Similarly, Marten Transport in its first-quarter earnings report said “the freight market recession’s oversupply and weak demand, inflationary operating costs and cumulative impact of freight rate reductions and related freight network disruptions continue to significantly pressure our earnings.

“We remain focused on minimizing the freight market’s impact on our operations while investing in and positioning our operations to capitalize on profitable organic growth opportunities,” Marten’s earnings report said.

Marten has not agreed to rate reductions since last August, saying it is focused on “fair compensation for our premium services, across each of our business operations, for what comes next in the freight cycle as the market necessarily recovers from its current recessionary late stages.”

Heartland Express, long known for its excellent operating ratios, saw a net loss of $15.1 million for the quarter and an operating ratio of 105.3%.

The results, said CEO Mike Gerdin, “reflect the combination of an extended and significant period of weak freight demand, driven by excess capacity in the industry, unfavorable weather early in the quarter, and ongoing operating cost inflation.”

Heartland “worked to reduce unprofitable freight, did not rely on broker freight, and refused to lower our freight rates to meet the unsustainable requests of certain customers,” all of which affected the carrier’s results.

“We continue to believe that the freight market will improve as more capacity exits the market so the industry as a whole can return to more disciplined operating decisions and improved financial results.”

At J.B. Hunt, company management said it won’t let its intermodal results (the company currently has 20% excess container capacity) deter it from its strategy, believing intermodal will take share over time and the company needs to be ready to take advantage of growth in demand.

“When we’re there to support our customer to grow the demand, it certainly bears fruit for our shareholders over the long term as those customers just gain more and more confidence in our ability to serve their needs, said Darren Field, president of intermodal services, on a call with analysts.

LTL a Bright Spot in Freight Markets

Less-than-truckload has been outperforming truckload, with a number of carriers taking advantage of Yellow’s exit from the market last summer.

Estes, the largest privately owned LTL, acquired 24 terminals from Yellow. It recently announced it is kicking off its initial wave of nationwide terminal openings, with eight scheduled to open by the end of June.

Old Dominion had “solid operational performance” in the first quarter, reported the transportation analysts at Stifel, yet the market responded poorly, fearing the company may not be able to keep ahead of competitors in growth.

“Our view is that LTL growth is not a zero-sum game,” the Stifel analysts said, “especially with recovering manufacturing, return to just-in-time inventory strategy, the return of freight that fled to TL and increased nearshoring.”

Knight-Swift is looking to grow its less-than-truckload business. In 2021 it acquired two LTL companies, AAA Cooper Transportation and Midwest Motor Express. The combined businesses made up only about 15% of Knight-Swift’s revenue in the first quarter, but as the Wall Street Journal notes, the LTL operations had a better operating margin than the far larger truckload segment — and the LTLs’ $20.3 million operating profit was nearly equal to the earnings of the far larger truckload operation.

When Will The Trucking Freight Market Get Better?

TFI International has both truckload and less-than-truckload subsidiaries. TFI’s first-quarter results, chairman and CEO Alain Bédard said in the Canadian-headquartered company’s earnings call, reflect “a solid performance given the economic cycle of the U.S. LTL business, which is picking up steam.

“We saw tonnage inflect positive in the quarter, leading to a 12% increase in revenue per shipment.”

However, “Truckload in Q1 was just a disaster,” Bédard said during the Q&A session. “It’s a very, very difficult market right now in the truckload.”

Bédard said he doesn’t think the freight recession will recover before 2025, in part due to election-year uncertainty. Some customers are delaying shipments until the result becomes clear, Bédard said. He gave the example of a green energy company whose wind turbine business could suffer depending on who wins in November.

Other company execs are a little more optimistic.

Old Dominion Freight Line CFO Adam Satterfield said his team sees the freight demand environment as needing “a little bit more improvement” to get to a tipping point.

“There have been some green shoots,” Satterfield said. “You can read through and see some potential opportunity for perhaps later this year.”

Knight Swift’s Adam Miller noted there was an uptick in demand around the Easter holiday, calling it a sign that some end markets have found a bottom.

“Some of that volume has come back…. it hasn’t led to premium pricing, but it has led to additional volume.”

-

AuthorPosts

- You must be logged in to reply to this topic.