Those waiting for signs as to whether expected changes in tariffs would be orderly or haphazard did not have to wait long. President-elect Trump on November 25 said in a social media post that he would sign an executive order on Inauguration Day imposing a 25% tariff on all imports from Mexico and Canada. Tariffs will remain until the countries stop the flow of drugs and migrants entering the U.S. illegally, he vowed.

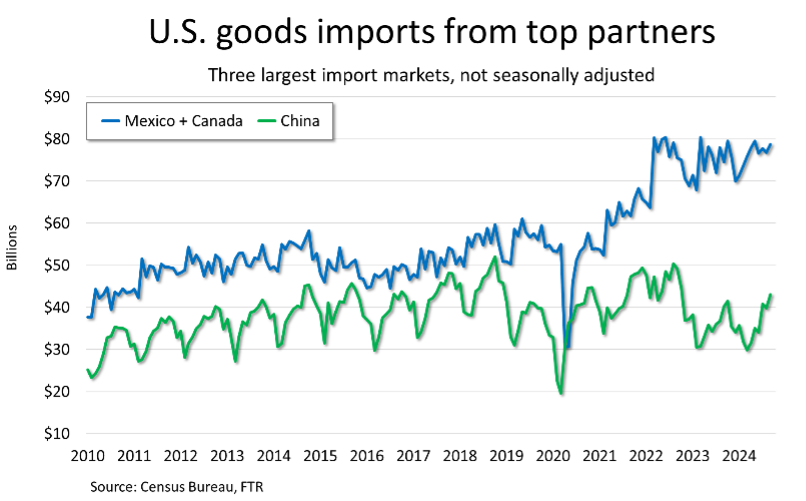

Trump also said that China is complicit by not taking action to stop illicit drugs from crossing the border into the U.S. from Mexico and said that he would add 10% to whatever tariffs on China are already in place or might be coming.

Tariffs clearly were destined to be a hallmark of Trump’s second presidency. A promise of 10% to 20% tariffs on all imports and 60% tariffs on imports from China to boost domestic production was one of his most consistent campaign talking points.

Until November 25, Trump’s plans for the country’s two largest trading partners were unclear. After all, Trump himself had signed off on the U.S.-Mexico-Canada (USMCA) agreement as a replacement for NAFTA during his first term. On the campaign trail, he floated prohibitive tariffs of 100% to 200% on vehicles imported from Mexico, depending on which campaign stop you reference. Otherwise, North American tariffs were not a specific focus.

Clarity is elusive when major policies are rolled out in social media posts. Businesses are left scrambling to determine their options in dealing with higher costs for nearly 30% of all U.S. imports by value, and that doesn’t even consider the potential for retaliatory tariffs on more than 33% of U.S. exports. Considering most of these imports and exports move by truck – obviously the only two major trading partners where that is the case – the outcome is a big deal for trucking.

Trump’s surprise announcement is only the beginning of disruptions due to tariffs, of course. The timing and scope of specific actions beyond North America are still uncertain. For now, the range of possibilities is so large that businesses likely will do little more than game out alternatives and, perhaps, carry a bit more inventory of goods from nations like China that are clear targets. As specifics about tariffs become clear, supply chain participants will take more concrete action.

Weighing Near-Term Options

Taken at face value, substantial tariffs on all imports from Mexico and Canada could begin on January 20, although perhaps the actual executive order will provide some sort of grace period to allow for a response to the ultimatum.

At this stage, though, businesses cannot assume anything because we have no details. Also, this is a pronouncement from a newly elected president who has not taken office, so there is no official source of clarification other than what Trump himself states.

We have assumed that impending tariffs would create a pull-forward effect allowing businesses to buy time for alternatives by building inventories through increased imports. This dynamic happened during the first Trump administration’s flirtation with tariffs. We see pull-forwards in other situations, too, most recently due to the anticipated work stoppage at East and Gulf Coast ports back in October.

A substantial pull-forward in response to the tariffs on Mexican and Canadian goods is a tall order because the timeframe is so compressed. Assuming the tariffs will be effective immediately – and at this point we really cannot presume otherwise – businesses have less than two months to rush goods across the borders.

Realistically, though, importers do not have even that much time because of holiday downtime. Indeed, Trump’s announcement came just before what is basically a three-day holiday for many people tasked with deciding what to do.

Even so, businesses likely will respond to the extent they reasonably can. Barring any more clarity on scope or timing, expect an elevated level of imports from Mexico and Canada and potentially from China. Looming tariffs might not yield ramp-ups in production, but it would be reasonable to expect a substantial movement of existing inventories across the border until further notice.

Beyond a pull-forward of readily available goods imports, the path forward is fuzzier. A key complication is the potentially limited duration of these tariffs. Trump’s social media post implies that Mexico and/or Canada could take some set of actions that would satisfy his demands related to drug traffic and illegal immigration. However, we do not know what those actions might be or, indeed, whether the ultimatum was merely a justification of tariffs that are intended to be permanent.

The answers to these questions are critical for how businesses respond beyond the initial pull-forward period. If these tariffs end fairly quickly – or perhaps don’t take effect at all – because of some deal, businesses would be better off staying the course and passing along added costs to their customers.

However, if businesses expect long-term tariffs on Mexican and Canadian goods, they presumably would seek alternatives. Due to labor and capital investment costs and constraints, domestic sourcing might be challenging in the near term at least, but businesses also must consider the likelihood of broader tariffs down the road. So shifting sourcing to countries other than Mexico, Canada, and China might only postpone the effects of tariffs.

Regardless, the costs associated with tariffs or steps taken to avoid them likely will be inflationary in the near term even with a strengthening of the dollar against the Mexican and Canadian currencies.

None of this analysis considers what happens if Mexico and Canada respond not by trying to pacify Trump but by retaliating with their own tariffs on U.S. goods. The mere anticipation of that possibility might lead Mexican and Canadian businesses to step up their imports in the near term. Don’t be surprised by massive congestion at key border crossings in December and January.

Even if the tariffs announced in November prove to be transitory, a tariff specifically on vehicles from Mexico remains on the table. Essentially prohibiting the import of vehicles from Mexico would be a huge deal, especially if those tariffs covered commercial vehicles as well as autos and light trucks.

Finished vehicles accounted for nearly 20% of the total value of Mexican exports to the U.S. in 2023 and currently account for about 15% of truck tonnage from Mexico. Parts and accessories for vehicles accounted for nearly 14% of Mexican exports to the U.S. by value in 2023, making that category Mexico’s largest export in terms of value.

Broader Tariff Implications

The tariffs on Mexican and Canadian imports were not even in the conversation before late November, but there were plenty of other tariffs to mull over. As noted earlier, one of candidate Trump’s most consistent talking points was universal tariffs with especially large tariffs on Chinese goods.

Trump’s sudden plan for Mexico and Canada might shift thinking on tariffs somewhat. Businesses that had presumed an orderly process for proposing and adopting tariffs might now consider building and holding some excess inventory as a buffer.

Aside from North America-sourced goods, we would not expect a noticeable pull-forward yet. For starters, nothing is clear in terms of scope or timing. Also, interest rates are still high, so carrying costs for inventories are still unattractive even if businesses have sufficient warehousing space. Obsolescence also is a worry, especially for consumer goods.

At some point, though, we will have likely or certain dates for another round of tariffs, and the result will be a pull-forward much like the one seen on a more limited scale during the first Trump administration. The question is whether such a pull-forward will benefit trucking.

Based on this year’s experience, it is not clear that a pull-forward would benefit trucking that much, at least not in today’s market. In part due to a pull-forward because of an impending port strike on the East Coast, container volumes this summer briefly hit levels approaching the highs seen in 2021 and 2022 and were still high through October. However, that strength did not drive up dry van spot rates.

The underlying reason for strong imports also is critical. Pandemic-era container volume soared due to extraordinary consumer demand. The market was under pressure not only to bring in lots of goods but also to move them quickly to points of sale. That created stress on trucking far beyond transloading freight from an overwhelmed rail intermodal sector.

If container imports are elevated due to a desire to boost inventories to avoid tariff costs, shippers presumably would not feel much urgency to move them quickly and would be willing to allow shipments to dwell at various stages in transit if necessary. They will care more about managing transportation costs than they did in 2021 and early 2022.

Trump tariff policies could drive a pull-forward of exports, too, as foreign companies that rely on U.S. goods might accelerate purchasing to avoid retaliatory tariffs that their own countries might impose. This scenario is more complicated to game out because it involves another layer of assumptions, but a pull-forward of exports could be doubly significant as it might result in stronger manufacturing output, at least temporarily.

Regardless of the scope of a pull-forward of imports and exports, we presume a comparable decline in activity following implementation. Carriers probably should not make capital or driver recruiting investments based on that activity alone and should instead rely on surge capacity options.

A Complicating Factor

Tariffs are not the only factor that might affect how U.S. businesses act in the coming months. Another is the proposal for large-scale deportations of undocumented residents as well as a tightening of the standards for legal immigration.

Even if U.S. manufacturers are not worried about a direct impact on factory labor, they might be concerned about the follow-on impact of reducing the active labor force. For example, manufacturing and trucking compete with construction for labor.

If a sharp decline in labor availability were to drive up pay for construction workers, manufacturers and trucking companies could face greater recruiting and retention challenges. To the extent that outcome stresses driver availability, it might be good for trucking companies’ margins. However, tighter labor will not help manufacturing output.

The rise of robotics makes labor less of an issue for manufacturing than it was a decade or two ago, but it remains a critical concern. Labor constraints on output could counteract the domestic production incentive created by higher tariffs.

A Work in Progress

In the midst of all this turmoil, it is worth remembering that the endgame is a reshoring of manufacturing output lost to globalization over the past few decades. Such a transformation, if it happens at all, would be years in the making. However, if reshoring were successful, trucking would benefit greatly even with lost export activity that we would presume as a consequence. The question remains: Can we get there from here?

FTR’s 2025 Transportation Outlook: Transportation Challenges in a Shifting Political Landscape

Join the FTR team on January 9th for our annual complimentary webinar – FTR’s 2025 Transportation Outlook: Transportation Challenges in a Shifting Political Landscape – Register here

Like this kind of content?

As a member of the Wnbaz, stay on top of emerging trends and business issues impacting transportation and logistics; learn the importance of gender diversity in the workplace and the need for more women drivers; and see best practices in encouraging the employment of women in the trucking industry. Join today! Learn More