Trucker Access › Forums › Diesel News › Scaling Electric Trucks: NACFE Reveals Key Findings on Cost, Infrastructure – Fuel Smarts

- This topic has 0 replies, 1 voice, and was last updated 8 months, 3 weeks ago by

EazyRiDer66.

EazyRiDer66.

-

AuthorPosts

-

July 11, 2024 at 10:45 am #29434

EazyRiDer66Keymaster

EazyRiDer66Keymaster

The purpose of ROL-E Depot was to look at the experience of fleets that were scaling up to larger numbers of BEVs.

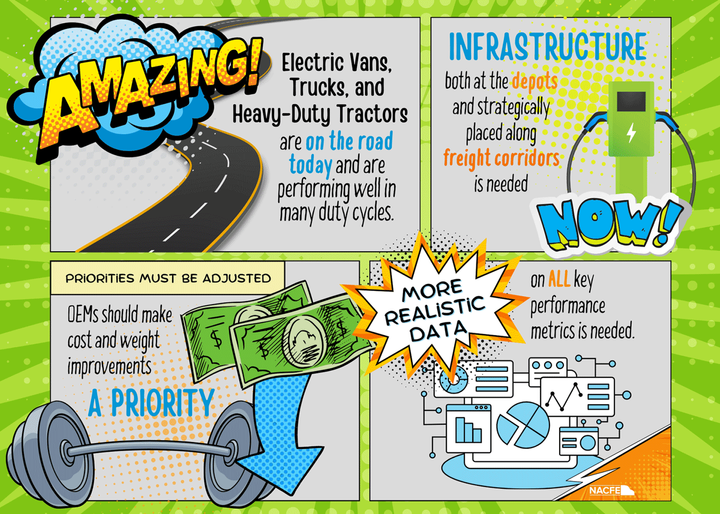

While battery-electric commercial vehicles from vans to heavy-duty tractors are on the road today and perform well in many duty cycles, in order for the trucking industry to scale electric trucks in operations, there are areas that must be addressed, according to the North American Council for Freight Efficiency in its final report on its Run on Less Electric – Depot demonstration project:

- Battery-electric truck charging infrastructure

- Cost and weight of heavy-duty electric trucks

- More realistic and better data on key performance metrics.

What is Run on Less – Electric Depot?

NACFE’s 2023 Run on Less – Electric Depot demonstration project tracked 22 battery-electric vehicles from Class 2b through Class 8 operating out of 10 depots in New York, British Columbia and California.

While many fleets have been evaluating electric trucks in their operations with one or two vehicles, the purpose of ROL-E Depot was to look at the experience of fleets that were scaling up to larger numbers of BEVs, including:

- Frito-Lay operating two Ford E-Transits in Queens, New York.

- OK Produce operating an Orange EV e-Triever yard tractor and a Freightliner eCascadia in Fresno, California.

- Penske operating a Ford E-Transit, a Freightliner eCascadia, a GM BrightDrop ZEVO 600, and an International eMV in Ontario, California.

- PepsiCo Beverages operating three Tesla Semis in Sacramento, California.

- Performance Team Logistics operating two Volvo VNR Electrics in Commerce, California.

- Purolator operating a Ford E-Transit and a Motiv EPIC in Richmond, British Columbia, Canada.

- Schneider operating two Freightliner eCascadias in South El Monte, California.

- UPS operating a Freightliner eCascadia and a Freightliner Custom Chassis Corporation MT50e in Compton, California.

- US Foods operating two Freightliner eCascadias in La Mirada, California.

- WattEV operating a BYD 8TT and a Nikola Tre BEV in Long Beach, California.

Initial ROL-E Depot Findings

The initial findings, released shortly following the demonstration run in September 2023, were:

- Small depots are ready for electrification now.

- Electrification at large depots is gaining momentum.

- There have been big technology and production improvements since Run on Less – Electric in 2021.

- The trucking industry needs cost and weight reductions to improve TCO.

- Range can be extended with multiple charging events during a shift or en route.

- BEVs are empowering diversity and inclusion, and energizing initiative and passion.

- Powering up electric charging infrastructure is taking too long, but portable/temporary charging is helping.

Following the initial report, data from the Geotab telematics devices installed on the trucks was made available to researchers for deeper analyses. NACFE conducted a Run on Less – Electric Depot Data Workshop in March 2024, where participants were invited to present their own analyses of the Run data.

The final data analysis, released in a July report from NACFE and RMI, confirmed and validated those results, but also reported some additional findings.

Final NACFE Findings on Scaling Electric Trucks in Commercial Fleets

1. Electric vans, trucks and heavy-duty tractors are on the road today and are performing well in many duty cycles.

Despite challenges, many fleets are deploying BEVs at scale in their operations. This list includes not only the 10 fleets that participated in Run on Less – Electric Depot but also companies such as Amazon, NFI and Ikea.

2. Infrastructure, both at the depots and strategically placed along freight corridors, is needed now.

One stumbling block to depot electrification is the need for a wider charging network. The place to begin is at or between depots and along freight corridors. Fleets can help with this by working in partnerships where two or more companies combine charging use to maximize charger asset utilization.

Fleets need to be aware that planning time for utilities is significantly longer than what they are used to. Utilities need to give fleets realistic timelines for project completion, as explored in the HDT Fact Book 2023.

The US National Blueprint For Transportation Decarbonization and the National Zero-Emission Freight Corridor Strategy outline a vision for the vehicle technologies and infrastructure required to transform commercial freight transportation from fossil fuels to zero-emission energy sources.

The final report on ROL-E Depot data showed several areas that need to be a priority for wide-scale adoption of heavy-duty electric trucks.

3. Heavy-duty tractor OEMs should make cost and weight improvements a priority.

It is still difficult for many fleets to make the TCO case for BEVs based solely on hard costs, but factoring in things like driver satisfaction and achieving sustainability goals can result in a better TCO case.

In addition, more information is needed on the cost of trucks, chargers, energy, infrastructure installation, etc. Vehicle weight has a direct impact on how much payload can be carried. Even with the 2,000-lb. weight exemption for Class 8 vehicles, the weight of the batteries is impacting payload as well as range.

But it is important to keep in mind that today, even with diesel-powered trucks, not every load reaches maximum gross vehicle weight. The more exact the understanding of freight weights, the better the electricity needs for BEVs can be estimated. This will help fleets better match BEVs to duty cycles.

In the meantime, OEMs need to continue to refine electric-truck batteries with weight reduction as a key goal.

4. More realistic data on all key performance metrics is needed.

There is a need for better quality performance data on BEV operations — not measured solely on the vehicle, but also measured at the charger, at the depot and from a utility perspective.

Information needs to be realistic and not focus on “worst case” scenarios as those do not accurately represent the reality of the current state of BEV development.

In addition, it takes a joint effort from a variety of sources to electrify a depot, and each of these participants requires their own type of data for different reasons

“These additional findings are things that everyone involved in the effort to decarbonize freight movement can be working on,” said Rick Mihelic, NACFE’s director of emerging technologies and lead author of the report.

“We have built up quite a bit of data which demonstrates that BEVs are working in a wide variety of transportation applications, but we are aware that there are still issues that need to be addressed. Collaboratively and collectively, we can address the changes and improve the TCO case for BEVs for more fleets.”

[embed]https://www.youtube.com/watch?v=PXLgV52zJ-E[/embed]

Plan EV Operations For Your Fleet’s Needs, Not Worst-Case Scenarios

In a press conference discussing the results, Mihelic elaborated with an example regarding the “worst case” issue in response to a question.

“One of the fleets was having challenges getting permanent charging infrastructure, but they were able to use interim temporary equipment to get the trucks rolling instantly while waiting for the utilities to get their ducks in a row for long term charging,” he said.

Initially, the fleet had planned its permanent charging infrastructure based on one charger per truck. Using the temporary charging, however, “they found they were able to charge multiple vehicles per day,” Mihelic said.

“If you don’t have that first-hand experience, you’re going to gravitate to worst case assumptions and potentially over build,” he said.

“In this case it was good because they were planning to add more EVs in the future anyway, and now they don’t have to go back to the utility and ask for more power.”

But you could imagine that in other instances, overbuilding like that would not have such a happy ending.

NACFE is in the early stages of planning its next Run on Less demonstration event, scheduled to be held in 2025.

-

AuthorPosts

- You must be logged in to reply to this topic.