Trucker Access › Forums › Diesel News › Why Medium-Duty Truck Fleets Need Retreads – Equipment

- This topic has 0 replies, 1 voice, and was last updated 11 months, 1 week ago by

EazyRiDer66.

EazyRiDer66.

-

AuthorPosts

-

May 15, 2024 at 4:15 am #20543

EazyRiDer66Keymaster

EazyRiDer66Keymaster

Package delivery trucks are the best candidates for medium-duty retreads, but almost any application using Class 2-6 vehicles could benefit from retreading.

The benefits of retreading are well understood by operators of big trucks. The economics of retreading tires for Class 7 and 8 trucks are irrefutable. Over the past few years, many fleets with a history of retreading have diversified and staked out places in the last-mile market — and have brought with them their enthusiasm for retreading.

They realize that the economics of retreading smaller tires are equally if not more compelling. And retreading tires in that market comes with additional benefits: less downtime for tire-related servicing, good optics aligned with sustainability, and lower acquisition costs for application-specific tires.

Jon Wilkins, Michelin North America’s urban marketing manager, says retreading of 17.5 and 19.5 tires has traditionally been a fringe market outside of fleets with larger equipment where retreading is the norm. But that’s changing, he says.

“As more of the traditional [less-than-truckload, pickup-and-delivery,] and food and beverage fleets move into the last-mile space utilizing medium-duty vehicles, demand for retreading those tires is increasing,” Wilkins says. “[Past experience] has helped reinforce the benefits of retreading, since these fleets have traditionally retreaded on their larger equipment.”

Goodyear, for instance, this year introduced its Endurance RSA ULT, a premium 17.5-inch all-position tire that’s also equipped to handle the higher load capacities of EVs. Among the features the company is touting are a premium casing that provides toughness and durability from curbing for maximum retreadability.

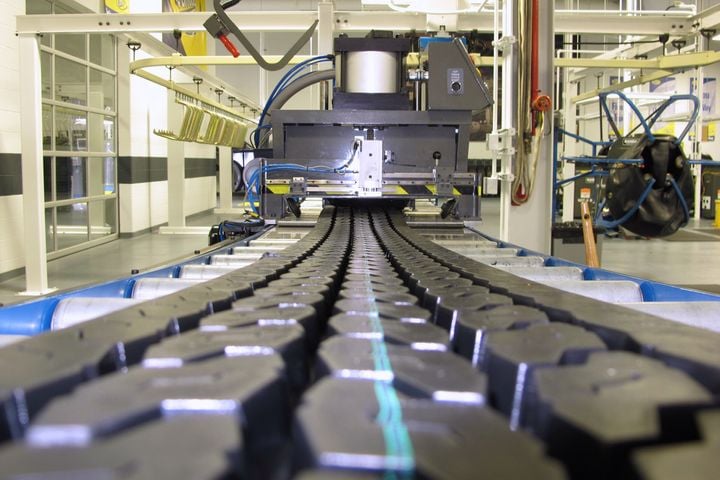

Retreading in medium-duty isn’t new, but there’s been a spike in interest with the advent of last-mile delivery services.

The Myth of Cheap Tires

The explosion of last-mile and local delivery services in recent years has pushed demand for smaller tires into the stratosphere. Compounding demand for such tires is their relatively short lifespan. Last-mile is a harsh environment characterized by high numbers of turns, scrubbing and curbing, and high-torque starts and stops.

“Some tires in that environment will last a year. Some of them will make it barely a month,” says Christine Regan, director of light-duty retread solutions at Bridgestone Americas. “That’s why a lot of fleets — especially smaller fleets — get trapped in the spiral of buying cheap tires.”

Cheap tires, at the front-end, might appear to be a solution to high tire costs, but it seldom works out in the long term.

“Those fleets are just trying to keep their head above water,” adds Ben Rosenblum, executive director of commercial development at Bridgestone. “We know they’re buying cheap tires; we know why they’re buying cheap tires. They’re acting very rationally … but it’s a wasteful and very inefficient way of managing tires.”

Based on insights they gained while developing Bridgestone’s nascent Last Mile Tire System program, Regan and Rosenblum say many smaller fleets are more concerned with cash flow (an obviously vital consideration) than seeking out true value and long-term savings. Many of them have never considered retreaded tires as an option, despite the fact that retreads are about a third of the cost new premium tire.

“Retreading has two fundamental benefits for the medium-duty segment,” Wilkins says. “The first being the total cost of ownership savings accrued from using the full life cycle value of the casing. The second benefit is for companies that are keyed into sustainability. Retreading helps to reduce landfill waste and raw material usage.”

With technological advancements in retreading over the last couple of decades, Wilkins says a medium-duty fleet can reliably retread on the drive position, spreading the initial cost of the casing over several lives, which leads to significant cost savings.

Soft on Tire Management

When Regan and Rosenblum were developing LMTS, they saw fleets taking a highly reactive approach to tire management. They were buying low-cost tires, which don’t always hold up well to rigorous urban driving cycles, and they were replacing them as they wore down, but not always at the optimal end of life tread depth.

“They might go in for an oil change, and the dealer would point out that their tires were getting close to the pull point,” Rosenblum explains. “Not only were they paying the rack price for inexpensive tires, but they also probably pulled a tire or tires prematurely, leaving a bunch of tread behind.”

The operators were concerned about the downtime involved in taking the trucks off the road for tire service, so they were inclined to replace the tires while they were having other work done on the truck, he says.

Even basic tire maintenance, such as checking for signs of irregular wear and inflation pressure monitoring, escapes most small fleets. Few of them would see the value in implementing a tire management system because they probably don’t have the resources to make it work. Instead, they continue to buy cheap tires and run them as long as they can, hoping they aren’t hit with a rash of failures at month’s end when the money is tight.

What would it take to get owners of small package delivery fleets, or even landscapers, electricians and plumbers, interested in a tire management program that will save money?

“Simplicity and transparency,” says Jason Roanhouse, executive director of Bandag operations at Bridgestone Americas. “Leveraging digital technology to manage vehicle data, coupled with mobile assets to serve the customer on demand, and a broad network of locations to provide convenience will create opportunities for tire companies.”

Roanhouse says the focus needs to shift from simply selling tires to managing a customer’s tires in the most economical and environmental manner possible, regardless of the fleet size or application.

“If we can provide retreading as a reliable and simple way to reduce cost, with no noticeable difference in appearance or performance, the customer can focus on their business and not their tires,” he says.

That’s what Bridgestone hopes to accomplish with the Last Mile Tire System program.

Electric powertrains will have an impact on tires, likely accelerating wear and thus driving up consumption. Retreading will have a role to play there.

Renting Rubber by the Inch

With LMTS, fleets pay for the rubber they use. Customers are billed monthly by the 32nd of rubber consumed, not by the mile. Consumption rates would be quite different in an over-the-road application compared to an urban door-to-door delivery service. Bridgestone owns the tire and is responsible for its maintenance.

If for example, service technicians pull a tire from service before it’s worn down to DOT minimum tread depth, the loss of tread life costs Bridgestone, not the fleet.

Further, LMTS can help with cash flow by smoothing out monthly costs and eliminating the spikes incurred when replacing a load of tires at once. The monthly billing stabilizes fairly quickly for fleets with regular routes. This allows them to begin budgeting for tire expenses rather than taking a cash-flow hit when tires need to be replaced or serviced.

Service calls are made after hours so trucks don’t need to be sidelined for tire service, which all but eliminates tire-related downtime, Bridgestone officials say. The per-32nd billing is all inclusive, and includes mounting/dismounting, balancing when required, valve stems, disposal/environmental fees, etc. On top of that, customers get a premium retreaded tire tailored to the application for a lower lifecycle cost than an off-the-shelf cheap imported tire.

Bridgestone plans to leverage data collected from vehicles to monitor tire condition, tread depth, inflation pressure and wear trends. At larger locations, sensors embedded in pavement will record these parameters, while hand-held readers will be used at smaller fleet locations.

“The Tyrata system is best for higher traffic sites and to work best, it requires multiple, regular drive-overs,” according to the company. However, it also is developing other solutions to help smaller fleets gain similar benefits. “We have multiple options for handheld tread depth sensors that integrate into our tire management programs, as an example.”

While Bridgestone is breaking new ground with its LMTS program, retreading for smaller tire sizes has been around for some time. The trick will be overcoming the fragmentation in that sector and managing these programs at scale. As many know, managing small fleets is like herding cats. Still, Bandag’s Roanhouse sees a huge opportunity for better tire management, and ultimately less tire waste and lower operating costs for those fleets.

“I think these customers are expressing an interest in an opportunity to serve their needs more efficiently and quickly while increasing the availability of revenue-generating equipment and reducing tire-related interruptions,” he says.

This article appeared in the November/December 2022 issue of Heavy Duty Trucking.

-

AuthorPosts

- You must be logged in to reply to this topic.